Jan 6, 2026

For years, fintech infrastructure has evolved rapidly - payments stacks, data platforms, developer tooling, fraud engines, and financial operations systems have all matured at incredible speed. But one critical layer has been consistently overlooked:

A purpose-built CRM for compliance.

Most compliance teams today still operate without a true system of record for customer risk, investigations, and regulatory context. Instead, they rely on a patchwork of internal tools, spreadsheets, case management systems, vendor dashboards, and repurposed platforms like Salesforce or Retool - none of which were designed for the realities of modern compliance operations.

As fintechs scale across geographies, products, and regulatory regimes, this gap becomes one of the most dangerous forms of technical debt in the organization.

Why Traditional CRMs Fail Compliance Teams

Traditional CRMs were built for sales and customer success.

They track contacts, deals, conversations, and pipelines - not risk.

Compliance teams, on the other hand, need to manage:

identity and entity structures

KYC / KYB and ongoing due diligence

transaction histories across fiat and blockchain

sanctions, fraud, and behavioral signals

alerts and investigations

regulatory filings and audit trails

Trying to force this complexity into generic CRMs or internal admin tools creates operational drag, blind spots, and significant regulatory risk. Teams spend more time stitching data together than actually analyzing risk.

The result is predictable: manual processes, duplicated work, fragmented visibility, and constant reliance on engineering just to keep the lights on.

Why Traditional CRMs Fail Compliance Teams

A true compliance CRM is not just about storing customer records.

It must become the system of intelligence and action for compliance and risk teams.

At its core, a compliance CRM must provide:

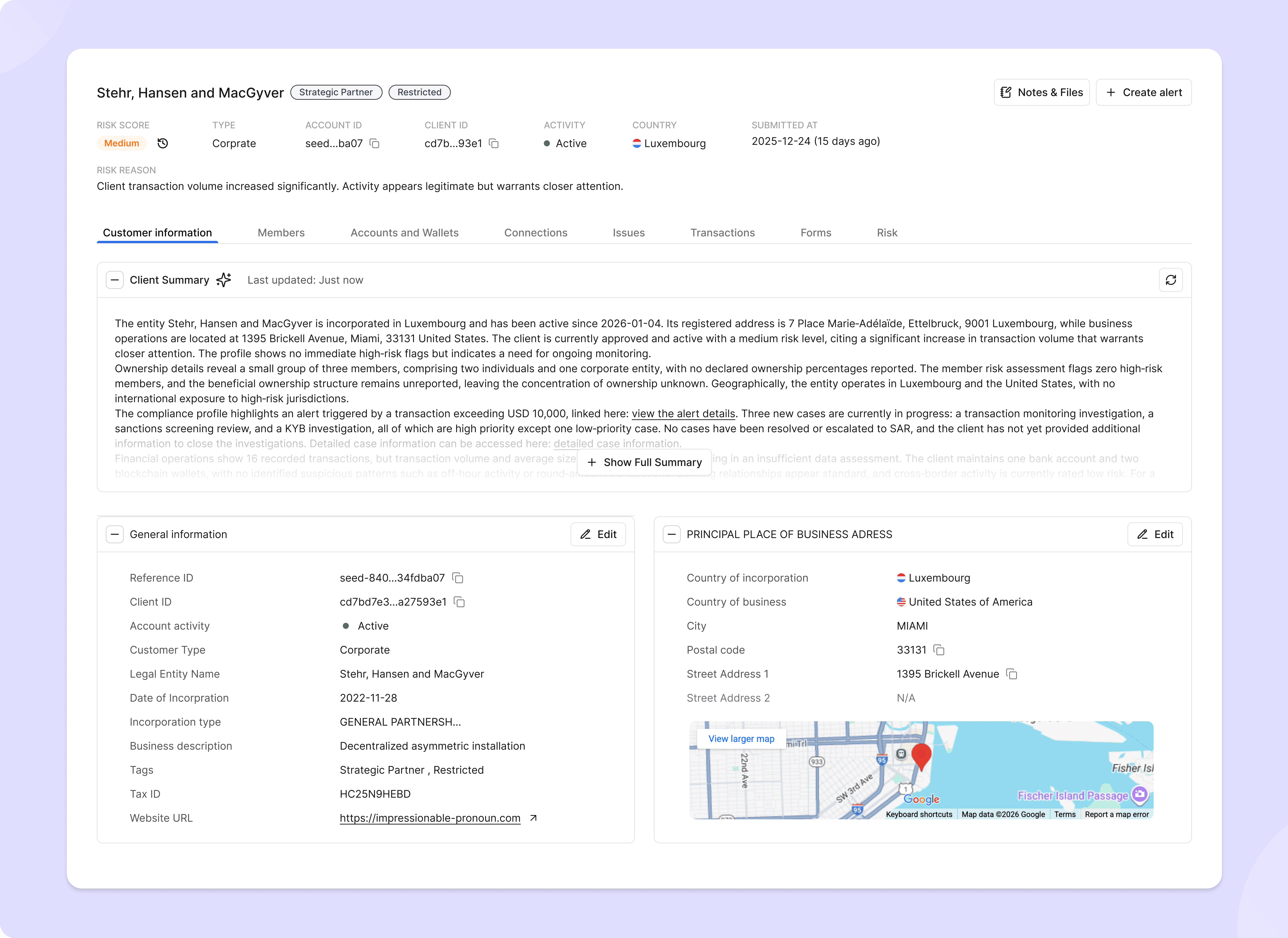

A unified customer profile

Every user, business, and counterparty represented through a single, dynamic record - enriched by data from onboarding, KYC/KYB, transaction monitoring, blockchain analytics, fraud systems, internal tools, and vendor platforms.

Continuous risk context

Risk is not static. It evolves with behavior, transactions, counterparties, alerts, and regulatory exposure. A compliance CRM must track how and why risk changes over time.

Native collaboration

Investigations, notes, documents, escalations, approvals, and decisions must live directly on the customer record - not scattered across inboxes, Slack threads, and shared drives.

Operational control

The CRM must connect directly to workflows: triage, investigations, EDD, RFIs, monitoring rules, reporting, and filings – with full auditability and governance.

This is not a reporting layer.It is the operational backbone of compliance.

How Corsa Rebuilds the Compliance CRM

Corsa’s Compliance CRM was built from the ground up as the core module of the Corsa Operating System.

Instead of retrofitting compliance into tools that were never designed for it, Corsa provides an out-of-the-box system of record that unifies:

identity and onboarding data and documents

sanctions and screening results

AML and fraud signals

fiat and blockchain transaction activity

alerts, cases, and regulatory history

Network analysis and indirect connections across your customers

documents, communications, and internal records

Customer support communications

Cross team collaboration, notes and comments

All of this information is organized into a single, live customer profile that evolves in real time as new data arrives.

On top of this foundation, Corsa layers AI-driven insights that summarize customer behavior, explain risk changes, surface anomalies, and assist investigations - allowing teams to move from reactive processing to proactive risk management.

Why This Layer Matters More Than Ever

As fintechs expand into new markets, launch new products, and support both fiat and digital asset flows, compliance operations are becoming one of the most complex functions in the company.

Without a real compliance CRM:

leadership lacks true visibility into risk exposure

teams struggle to scale, grow across geos and product lines without adding headcount

audits become fire drills

and compliance becomes a bottleneck to growth

With the right system of record in place, compliance transforms from an operational burden into a strategic advantage.

The New Standard for Compliance Infrastructure

The compliance CRM is no longer optional infrastructure for regulated fintechs.

It is the foundation upon which scalable, intelligent, and resilient compliance operations are built.

This missing layer is now being filled.

And once teams experience a real compliance CRM, it becomes very difficult to imagine operating without one.